In the realm of decentralized finance, it emerges as a trailblazer, attracting attention with its concepts. Unleashing decentralized exchanges upon the Ethereum blockchain and employing security measures, the project is orchestrating a transformation in the landscape of digital finance. Join us as we find out how Loopring crypto works, see what is Loopring, and where to buy LRC.

Disclaimer: This article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.

What is Loopring (LRC)?

So, what is Loopring?It is like a special toolkit for creating decentralized exchanges on the Ethereum blockchain. What makes Loopring interesting is its use of zero-knowledge proofs, or ZK-rollups. This tech makes transactions faster and cheaper while keeping everything secure. In the world of decentralized finance, Loopring really stands out.

Now, there’s also a token called LRC that powers this toolkit. It’s not just any token — it’s the fuel that makes the whole system work. Talking about the LRC price — now there are hundreds of sources offering the Loopring (LRC) price prediction 2030, 2025 or even the next 2024 year.

Loopring – how does it work

Let’s simplify what the concept does and how it works. It is a decentralized system using zero-knowledge proofs to speed up and cheapen transactions while keeping them super secure. Unlike regular exchanges controlled by one big authority, Loopring works on a network where lots of computers (nodes) team up to make trades happen.

Now, here’s the interesting part — the ZK rollup. It’s like a boost for Loopring, working with the Ethereum network to make things smoother. In theory, it can handle over 2000 transactions per second.

The project mixes the benefits of PoW and PoS together to ensure privacy, security and efficiency of transactions.

Blockchain Loopring (LRC) operates on

Loopring works on the Ethereum. This is because it’s relatively easy for software developers to create their stuff on Ethereum. However, Loopring isn’t stuck with just Ethereum. It can also be used on any smart contract platform that supports EVM-compatible smart contracts.

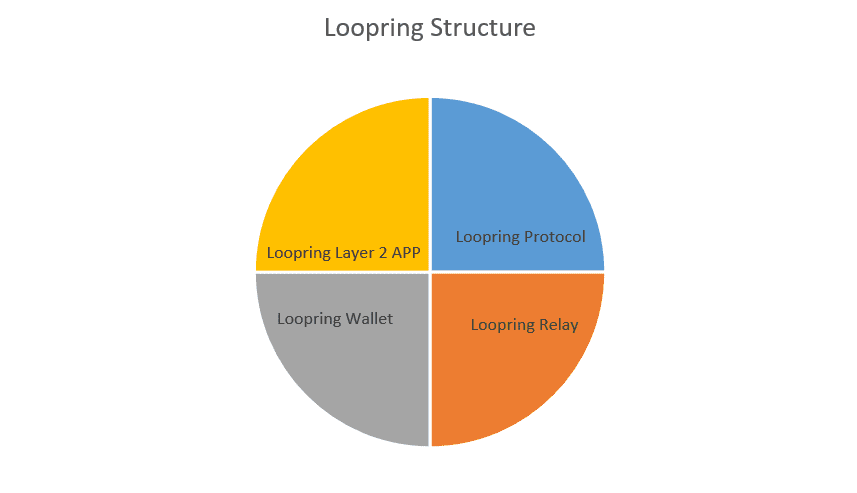

Let’s dive into the Loopring setup. It has three main products:

- Loopring Protocol: This is like the brain of Loopring. It sets the rules and standards for how decentralized exchanges should work.

- Loopring Relay: Picture this as the behind-the-scenes crew. It’s the off-chain layer that helps share orders and mine rings. There’s a network of nodes (basically computers) that chat with each other and with the Loopring Protocol.

- Loopring Layer 2 app: It is a fast, non-custodial exchange and payment platform operated by the Loopring team. It supports both automated market maker (AMM) and traditional order book trading, giving users control over their funds for a seamless experience.

- Loopring Wallet: This is where users come into play. It’s the interface, like the face of Loopring. It can be a web or mobile app, letting users manage their money, place orders, and trade on Loopring decentralized exchanges (DEXs). So, Loopring isn’t just for tech wizards—it’s built to be user-friendly too!

How To Use Loopring (LRC)

Two ways to use Loopring:

- Order Book Trading: Place limit or market orders on a Loopring DEX with an order book model. Your orders get matched in a circular trade known as an order ring. Smart contracts verify and settle the order ring on the Ethereum blockchain using zkRollups.

- AMM Trading: Swap tokens on a Loopring DEX with an automated market maker (AMM) model. Provide liquidity to an AMM pool, earning fees from other traders. Withdraw your liquidity anytime. The AMM trades are settled on the Ethereum blockchain using zkRollups.

History of Loopring

One of the most frequently asked questions — where is Loopring based? The project is the brainchild of Daniel Wang, a tech specialist from Shanghai, China. The company was based in 2017. A year ago, Daniel was replaced by Steve Guo, but continues to work as an adviser.

In August 2017, Loopring successfully conducted an Initial Coin Offering and raised an impressive $45 million, denominated in ETH.

How Is Loopring (LRC) Different To

Now we will make a short overview of various popular assets and compare them to LRC.

Crypto Bitcoin

Bitcoin does not facilitate smart contracts; its main function is to serve as a digital currency. The consensus mechanism employed by Bitcoin is Proof-of-Work.

Crypto Ethereum

Ethereum functions through accounts and balances, utilizing a process known as state transitions. It adopts the Proof-of-Stake.

Crypto Litecoin

Loopring stands out from this platform because it’s not only a cryptocurrency but also a protocol designed for constructing decentralized exchanges.

Advantages of Loopring

The key benefits of the project that might me highlighted:

- Security

- High throughput

- Low cost

Disadvantages of Loopring

However, any project has its own drawbacks. In this case, they are:

- Intricacy

- Smart contract risk

Notice that there might be more pros and cons. It requires your personal research.

Is Loopring Safe?

It is hard to be 100% sure that any cryptocurrency is safe. The crypto market is very volatile and there’s always a chance to lose some money. However, the same chances stand for profiting from investing. This only depends on the investors’ decisions and luck. It is important to be aware of the crypto trends, market changes, project updates, etc. So stay as informed as possible about the project you want to invest in and do your own research.

Buying Looping (LRC)

First, any investor willing to buy any crypto asset, e.g. LTC, should answer the question “Is Loopring worth buying?”. If the answer is “yes”, then, in order to purchase LRC, you may go to any cryptocurrency exchange you trust and buy the amount you need. You may also use SimpleSwap instant crypto exchange to quickly and safely swap your crypto for LRC.

The Bottom Line

Loopring presents a distinctive solution in the realm of decentralized finance by blending the advantages of both centralized and decentralized exchanges. Its utilization of Zero-Knowledge Proofs and ring mining sets it apart in the world of cryptocurrencies.