Since Donald Trump was re-elected as President of the United States, Bitcoin has skyrocketed. This surge has sparked renewed interest and speculation about Bitcoin’s potential price movements in the future. If you want to know, how high Bitcoin can go in 2025, this price analysis can be helpful for you.

Bitcoin has created a new all-time high (ATH) of $108,268.45 in December 2024, marking a significant milestone in its price trajectory. Now, many Bitcoin analysts predict that if the current pumping continues, Bitcoin may hit the target of $150,000 soon.

To analyze how high Bitcoin can go, we will explore various market trends, economic factors, and technical indicators that could influence its future price.

Current Market Dynamics

Recent Price Movements

Bitcoin’s recent ATH is not an isolated event but part of a broader trend characterized by increased capital inflows and positive market sentiment. Since early September 2024, net capital inflows into Bitcoin have surged significantly, indicating a robust appetite from investors. This influx of capital has been accompanied by a notable rise in profit-taking activities, suggesting that while many investors are realizing gains, the overall demand remains strong.

Investor Sentiment

The current market sentiment is bullish, with a Fear & Greed Index score indicating “Greed” at 69. This level of optimism often correlates with upward price movements, as more investors are likely to enter the market during such phases. Additionally, the options market is reflecting heightened volatility expectations, with a balanced distribution of put and call options suggesting uncertainty but also the potential for further price increases.

Factors Influencing Future Prices

1. Institutional Adoption

Institutional interest in Bitcoin continues to grow, particularly with the recent approval of Bitcoin Spot ETFs in the United States. Billions of dollars have inflows in the Blackrock ETFs recently. These financial products have made it easier for institutional investors to gain exposure to Bitcoin without directly purchasing it. Increased institutional participation is likely to drive demand and could lead to higher prices as more capital flows into the market.

2. The Role of Market Cycles and Halving Events

Bitcoin’s price movements historically align with its halving cycles, which occur approximately every four years. During these events, the reward for mining Bitcoin blocks is cut in half, effectively reducing the supply of new Bitcoins entering the market. After the Bitcoin halving in April 2024, many experts anticipated a bullish run, as reduced supply often leads to higher prices, assuming demand remains steady or increases.

In past cycles:

- 2012 Halving led to a sharp rally, followed by a price increase that took Bitcoin from around $12 to over $1,000.

- 2016 Halving fueled another bull run, where Bitcoin ultimately reached nearly $20,000 in 2017.

- 2020 Halving was followed by a significant rally, driving Bitcoin to its previous ATH of around $69,000 in November 2021.

- 2024 Halving skyrocketed the performance of Bitcoin and created a new ATH level of $81,858 in November 2024.

Given this pattern, many believe that the 2024 halving has created a similar upward momentum, possibly pushing Bitcoin’s price past $100,000 as demand remains strong. Some analysts predict that 2025 could be the peak of this cycle, based on past trends.

3. Potential Regulatory Developments

Regulation has always been a double-edged sword for Bitcoin. While restrictive regulations can cause temporary price drops, clear and supportive regulations can attract more investors and drive prices up. In 2025, the U.S. and other countries will likely introduce clearer Bitcoin and crypto-related regulations.

Donald Trump has emerged as the biggest supporter of Bitcoin which is already impacting the prices of Bitcoin. This could have a positive effect on Bitcoin’s price by providing more security and trust for investors. Especially if regulation leads to more financial products like Bitcoin ETFs, futures, and other derivatives.

4. Adoption of Bitcoin in Emerging Markets

Many emerging markets are experiencing currency instability, leading citizens to adopt Bitcoin as a reliable store of value and means of transaction. Countries like El Salvador have already adopted Bitcoin as a legal tender, while others are exploring the idea. If more nations follow suit, this increased adoption could significantly boost Bitcoin’s demand and price.

Moreover, remittances have become a major use case for Bitcoin. Many people in developing countries use Bitcoin to send money home, bypassing high remittance fees and delays. This trend is likely to continue, adding another layer of demand.

5. Market Sentiment and FOMO (Fear of Missing Out)

In past bull markets, FOMO has played a massive role in driving Bitcoin’s price up. As Bitcoin gains media attention for reaching new ATHs, new retail investors are likely to enter the market, hoping to get a piece of the action. This can lead to rapid price increases, as was seen during the 2017 and 2020-2021 bull runs. If Bitcoin reaches $100,000 or beyond, this psychological milestone could spark another wave of FOMO, leading to even higher prices as investors rush to buy.

6. Technological Developments

Advancements in blockchain technology and improvements in transaction efficiency can enhance Bitcoin’s utility and attractiveness as an investment. The ongoing development of layer-2 solutions like the Lightning Network aims to address scalability issues, potentially increasing Bitcoin’s adoption for everyday transactions.

Price Predictions for Bitcoin in 2025

While predicting an exact price is challenging, experts and analysts have provided several estimates for Bitcoin’s potential highs in 2025 based on historical trends and current market factors.

- Short-term Predictions (Mid 2025): Analysts predict that Bitcoin could reach an average price of around $159,983 by May 2025, with potential fluctuations between $95,481 and $125,369 during this period. This reflects continued bullish sentiment driven by ongoing capital inflows and market dynamics.

- Long-term Predictions (2025): Looking further ahead, some forecasts indicate that Bitcoin could potentially exceed $180,000 by the end of 2025 if current trends continue and institutional adoption accelerates. Factors such as market sentiment and institutional investment could further fuel price increases.

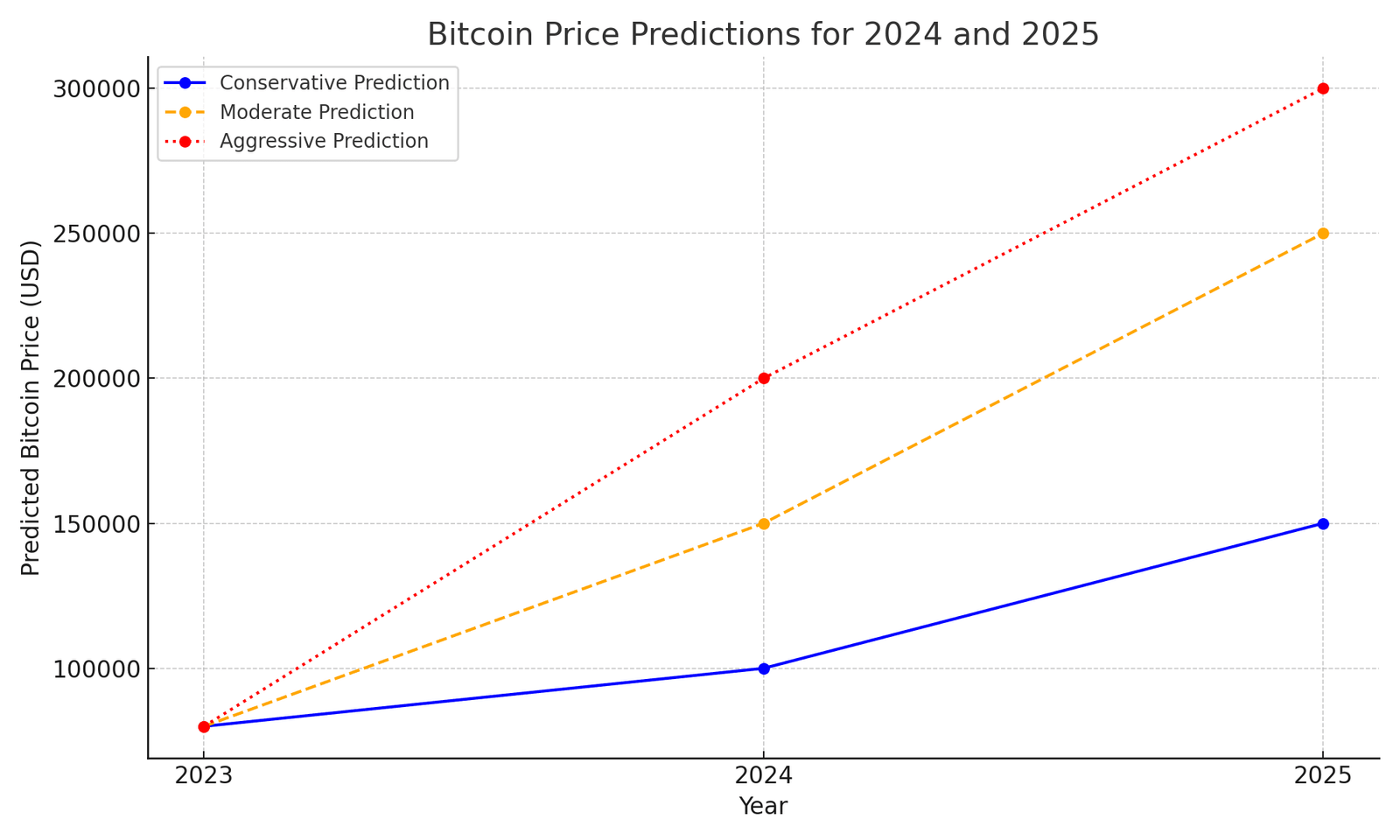

Conservative Estimates

Conservative estimates suggest that Bitcoin might reach between $130,000 to $150,000 by 2025. This estimate is based on historical post-halving price increases and assumes steady growth without major setbacks.

Moderate Estimates

Some analysts forecast that Bitcoin could reach $200,000 to $250,000 by 2025, especially if institutional interest and ETF approvals increase demand.

Aggressive Estimates

Optimistic scenarios suggest that Bitcoin could reach $300,000 or higher if widespread adoption, supportive regulations, and a strong macroeconomic environment exist. Some Bitcoin maximalists, who believe in the cryptocurrency’s potential to become “digital gold,” share this view.

Technical Analysis

Moving Averages

Technical indicators show a mixed but generally bullish outlook for Bitcoin. The 50-day moving average is currently rising, suggesting short-term upward momentum. While the 200-day moving average indicates long-term strength. This duality often signals sustained bullish trends if maintained.

Resistance Levels

Key resistance levels are identified around $80,000 and $85,000. A successful breakout above these levels could pave the way for new highs beyond $100,000. Conversely, support levels around $75,000 indicate where buying interest may emerge if prices begin to retrace.

Conclusion

Predicting exact Bitcoin prices remains challenging due to its volatility and sensitivity. However, the current market dynamics suggest a strong potential for Bitcoin growth in 2025. Factors such as increasing institutional adoption, favorable economic conditions, and positive investor sentiment support the case for higher prices.